Open enrollment for the Affordable Care Act (ACA) Marketplaces is about to wrap up with another record high number of people signing up for coverage. The number of people with Marketplace coverage has grown significantly each year under the Biden Administration, with enhanced subsidies in the American Rescue Plan Act and the Inflation Reduction Act making coverage more affordable for enrollees, and increased marketing, outreach, and enrollment assistance also playing a role.

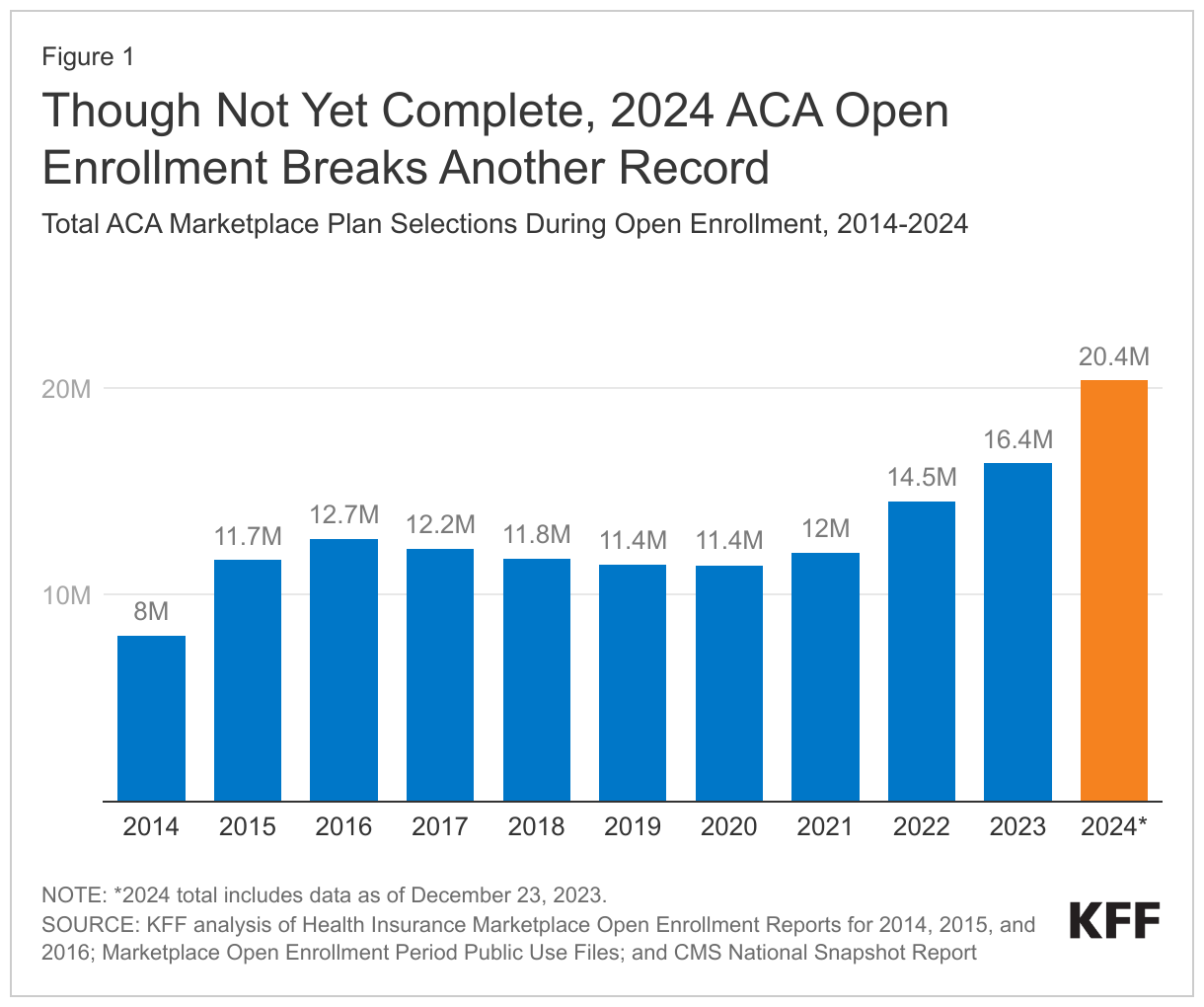

Though final enrollment numbers are not yet known, the latest data show that Marketplace signups have reached 20.4 million people, already exceeding last year’s record high by another 4 million people. (These signup data are as of December 23; Healthcare.gov open enrollment runs through January 16, 2024, and some states have extended open enrollment periods through the end of January, so the total number of signups will only grow).

Some of the growth from 2023 to 2024 is likely related to the unwinding of Medicaid continuous enrollment. During most of the COVID-19 pandemic, states had been prohibited from disenrolling people from Medicaid, but these disenrollments started again in April 2023. Since then, while millions of people have been able to renew their Medicaid coverage, over 14 million have been disenrolled. In some cases, people have been disenrolled because they were determined ineligible for the program, but others have been disenrolled for procedural reasons, meaning they were unable to complete the renewal process, and may still be eligible. Some of those losing Medicaid coverage have been able to reenroll in Medicaid, while others have moved to employer-based coverage or to the Children’s Health Insurance Program (CHIP); however, others have become uninsured. For those who are not eligible for Medicaid, CHIP, or affordable employer coverage, the Marketplace offers subsidies to make private coverage more affordable.

Unlike most previous years, the individual market grew mid-year, outside of the open enrollment window. From early April 2023 to the end of September 2023, before the 2024 open enrollment had begun, enrollment in the individual market (which includes the ACA Marketplaces, as well as off-exchange plans, many of which are also ACA-compliant), grew by 5.7%. This is approximately equivalent to a growth of just over 1 million individual market enrollees mid-year in 2023.

This mid-year growth in individual market enrollment is very unusual; in most recent years, there has been attrition from the market. The individual market is often a place where people come for insurance coverage when they are between other sources of coverage (for example, when they are between jobs or in school). As people leave mid-year, either for other sources of coverage or because they no longer find their Marketplace plan to be affordable, the number of people leaving usually exceeds the number of people coming into the market because there are only limited opportunities for other people to qualify for special enrollment opportunities and it can be burdensome to demonstrate eligibility to signup mid-year. Therefore, individual market enrollment tends to wane in the later part of the year. The only other time this market has seen mid-year growth in recent years was in 2021, when the enhanced subsidies in the American Rescue Plan Act were first rolled out and the Biden Administration and most state-based Marketplaces allowed broad opportunities for mid-year enrollment.

Medicaid unwinding is likely contributing to the 2024 record high enrollment, with individual market enrollment already being elevated by at least 1 million people before open enrollment began. Some people losing Medicaid coverage made their way onto the ACA Marketplace mid-year 2023, while others may have waited for open enrollment to make the transition.

Additionally, the Biden Administration closed the family glitch starting in 2023, so some dependents of people getting employer-based care may be finding a better deal on the Marketplaces than the coverage offered through their family member’s employer.

The enhanced subsidies in the Inflation Reduction Act are also a factor, as enrollment has grown substantially each year since they first became available. People are continuing to find out about the extra premium subsidies through additional outreach, as federal marketing budgets and funding for navigators and in-person assisters have increased under the Biden Administration following substantial reductions under the Trump Administration. The enhanced subsidies make the transition from Medicaid to private coverage easier cost-wise, as zero-premium plans with enhanced subsidies are available for many low-income people, particularly in states that did not expand Medicaid. In addition to drawing new enrollees to the ACA Marketplaces, these enhanced subsidies may also be helping existing enrollees afford to maintain their coverage. In 2022, as shown in Figure 2, there was much less mid-year attrition than had been the case pre-pandemic.

The number of people signing up for ACA Marketplace coverage has grown so rapidly in the past 4 years that 2024 signup numbers could reach almost double the number of people signed up in 2020. The enhanced subsidies in the Inflation Reduction Act have helped to make ACA Marketplace coverage more affordable for those transitioning off Medicaid. The enhanced subsidies will last through the end of 2025, at which point Congress must decide whether to let them expire or extend them further, requiring additional funding.

| Methods |

| Enrollment data is sourced from Health Coverage PortalTM, a market database maintained by Mark Farrah Associates Plans. A relatively small number of plans that only file annually (not quarterly) are excluded from this analysis. Insurers that did not file third quarter 2023 data with the NAIC as of December 4, 2023 are excluded from all quarters. We also remove likely Children’s Health Insurance Program, or CHIP, enrollees from the individual market total by using A&H Policy Experience Exhibit data. |